NBC News has the stats from a few traffic monitoring companies showing the drop in usage and downloads of the former Twitter app.

In February, X had 27 million daily active users of its mobile app in the U.S., down 18% from a year earlier, according to Sensor Tower, a market intelligence firm based in San Francisco. The U.S. user base has been flat or down every month since November 2022, the first full month of Musk’s owning the app, and in total it’s down 23% since then, Sensor Tower said.

The numbers were nearly as bad worldwide, as daily active users on the mobile app fell to 174 million in February, down 15% from a year earlier, the firm said. The worldwide user base has been flat or down every month during Musk’s tenure began except one, when it grew slightly in October and then resumed falling, according to Sensor Tower.

Other social media apps experienced modest increases in their worldwide user bases during the same period, according to the research, with Snapchat growing 8.8%, Instagram 5.3%, Facebook 1.5% and TikTok 0.5%. Those apps all experienced declines over that period in the U.S., but none was as steep as the decline on X.

X had “the most material decline in active users compared to its peers,” Abe Yousef, a senior insights analyst at Sensor Tower, wrote in a research report.

The company also struggles to retain advertisers with 75% of the top 100 ceasing their spend on X. The kinds of ads you see on the site are now primarily cryptocurrency, AI apps, individuals promoting their own accounts, and other oddities.

While there’s no numbers shared for individual countries or markets, traffic and attention for the Indonesian market seems to remain high or at least visibly active, despite the exodus reported worldwide.

What’s happening in the US and most of the English speaking community doesn’t seem to affect the Indonesian speaking users who continue to post and have conversations on the platform.

Politics, entertainment, and daily life activities dominate the discourse in the market especially with the general election happening in February and the results only just announced on Wednesday. The local scene on X seems to remain healthy more than a year after the acquisition and just under a year after the platform was legally reestablished under X Corporation.

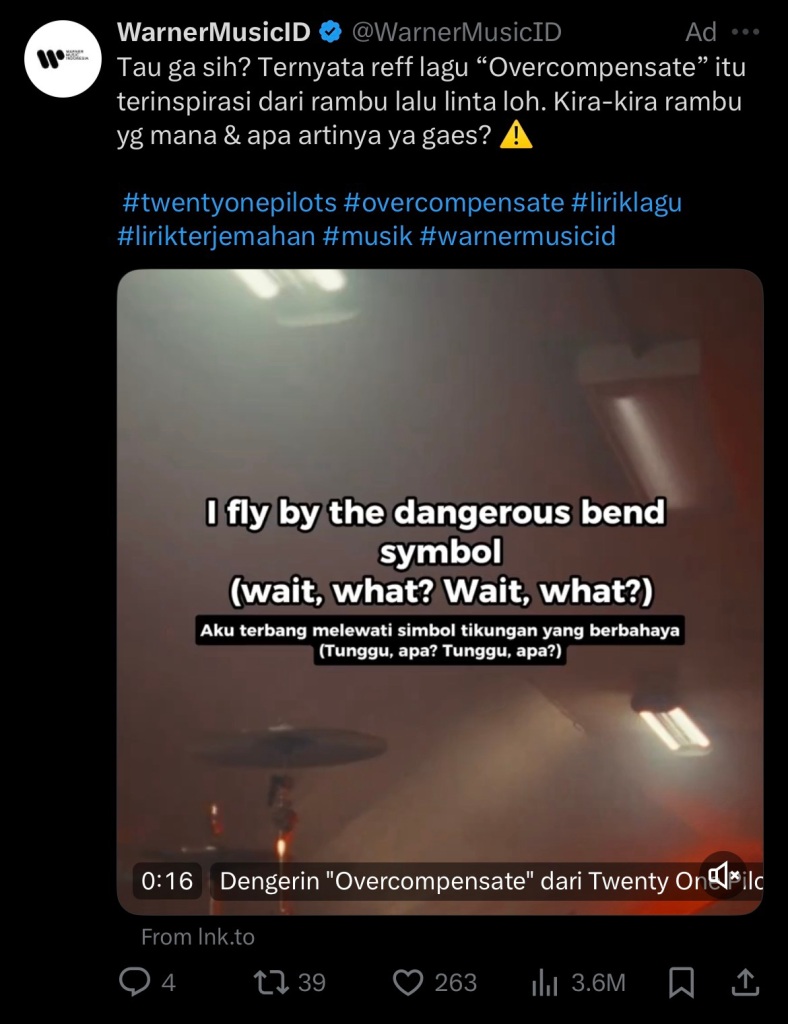

As the English speaking crowd slowly make their way to alternative platforms such as BlueSky, Threads, Mastodon, and other platforms on the social web, the bulk of the Indonesian crowd are mostly sticking to Instagram and TikTok in addition to X itself and major brands such as Bank Mandiri, BCA, Mitsubishi, Grab, Warner Music, and Indosat, are still buying spots on X.

There’s little to no push factor that will drive them away from the platform and no amount of pull will convince them to make a move. Unless there’s an existential threat to their presence on X or to X itself, it’s extremely unlikely for Indonesians on the platform to switch to another. The majority, especially the younger demographics, are already on TikTok and Instagram anyway because they prefer video platforms, which leaves text based alternatives a niche.